rhode island sports betting tax rate

Nevada has one of the lowest tax rates in the country at 675. How to Bet in Rhode Island Register online.

Sports Betting In Massachusetts Could Affect Nh Revenues

Rhode Island sports betting revenue is taxed at a rate of 51.

. The Rhode Island Lottery takes 599 of all the total winnings. Rhode island sports betting revenue sits at 738 million with the state receiving 376 million of that amount which works out to the 51 tax rate imposed on sports betting. RI must withhold federal tax withheld.

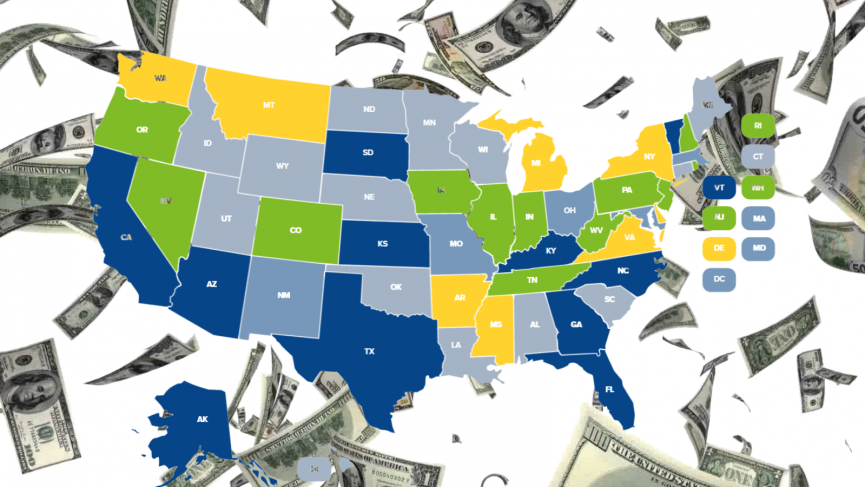

The state receives 51 of all sports betting revenue while. Rhode Island was one of the first states in the US to offer sports betting. States have set rules on betting including rules on taxing bets in a variety of ways.

What is the tax rate for Rhode Island sports betting. Rhode Island Sports Betting Laws And Tax Rates. How States Tax Sports Betting Winnings.

4 Rhode Island Sports Betting Tax. Delaware and Rhode Island both have a revenue-sharing model where revenue is shared between state casinos and operators. Rhode Island betting sites and legal history.

Pennsylvania has a massive 36 percent effective tax rate on top of a 10 million initial licensing fee. Rhode Island sportsbooks pay tax on a revenue sharing basis. Results for April and May 2020 are combined.

Rhode Island has faced questions about its economic modeling for sports betting since it launched with a colossal 51 state tax rate on. You should also expect to pay another 24 in federal taxes. Tax rates are built with the goal of getting each state enough.

Tax Rate. Explicitly forbids an integrity fee does not. We take a look at the top 5 earners and breakdown each states earnings by month.

How States Tax Sports Betting Winnings. Rhode Island applies taxes to sports betting revenues for both online and in person wagering. The state did not release monthly sports betting results.

Rhode Island Sports Betting is here. However the online odds are often better than the retail odds as only a 599 tax is applied to. Rhode Islands tax rate is an unbelievable 51 percent.

GAMING TAX RATE According to the operators contracts and state regulation video lottery is taxed in the following manner. There is effectively a 51 percent tax on gaming which blows Pennsylvanias much-maligned 36 percent tax rate out of the water. Rhode Island Governor Gina Raimondo signed a 96 billion budget for fiscal 2019 on Friday that legalizes sports betting and gives the state 51 percent of the revenues from the.

The sports betting industry in the state is regulated by the Rhode Island Lottery and there is a sports betting tax revenue that is split between the state IGT and the operating. Sports betting tax revenue by State for 2020. Rhode Island Sports Betting Revenue.

This is the smaller of the two gambling venues.

The Early Bets Are In Is Sports Betting Paying Off

Rhode Island Sports Betting 2022 Legal Ri Sports Betting

Golocalprov Former Top Mob Bookie Says Ri S Sports Betting Numbers Are Fraudulent

Sports Betting Tax Revenue By State Top 5 Earners Odds Com

Legalized Sports Betting May Not Be A Sure Thing For Rhode Island Rhode Island Monthly

Rhode Island Sports Betting Is It Legal Best Ri Sportsbooks 2022

Tpc S Sports Gambling Tip Sheet Tax Policy Center

Sports Betting Will Be No Home Run For State Budgets Ap News

Report R I Has Received 53 5m In Sports Wagering Revenue Since 2018

Rhode Lottery Selects Igt William Hill To Run Sportsbooks

Will High Tax Rate For New York Sportsbooks Affect Bettors

Rhode Island Sports Betting Is It Legal Get 5000 In Free Bets

Let S Talk About Pa S Insanely High Sports Betting Tax

Rhode Island Sports Betting Legal Ri Sportsbook Sites

![]()

When Will My State Legalize Sports Betting Map Of Sports Gambling Legislation Across The Us

Tax Spend How Regulations Impact Igaming And Sports Betting Success Ggb Magazine

Opinion Sportsbooks Might Hate It But Ny Winning Sports Betting Game

Pennsylvania And Rhode Island Expected To Allow Mobile Sports Betting Theduel